AUD/USD bulls defending critical 0.7650 ahead of RBA next week

- The Reserve Bank of Australia releases its rate statement next week on Tuesday.

- The AUD/USD bears are trying hard to break below 0.7650 but the technical configuration is far from ideal.

The AUD/USD is trading at around 0.7668 virtually unchanged on Thursday as we are entering the Easter break.

Earlier in the US session, the Core Consumer Personal Expenditure (CPE) came in line with analysts expectations and didn’t surprise much the currency markets. Since Tuesday the US Dollar Index (DXY) is having a boost and has jumped $1 from $89 to the $90 handle on Wednesday. Affecting the positive mood on the DXY are the end of the month and quarter flows which benefit the US Dollar, as well as the receding threat of an all-out trade war between the US and China with both parts which now seem to be ready to negotiate.

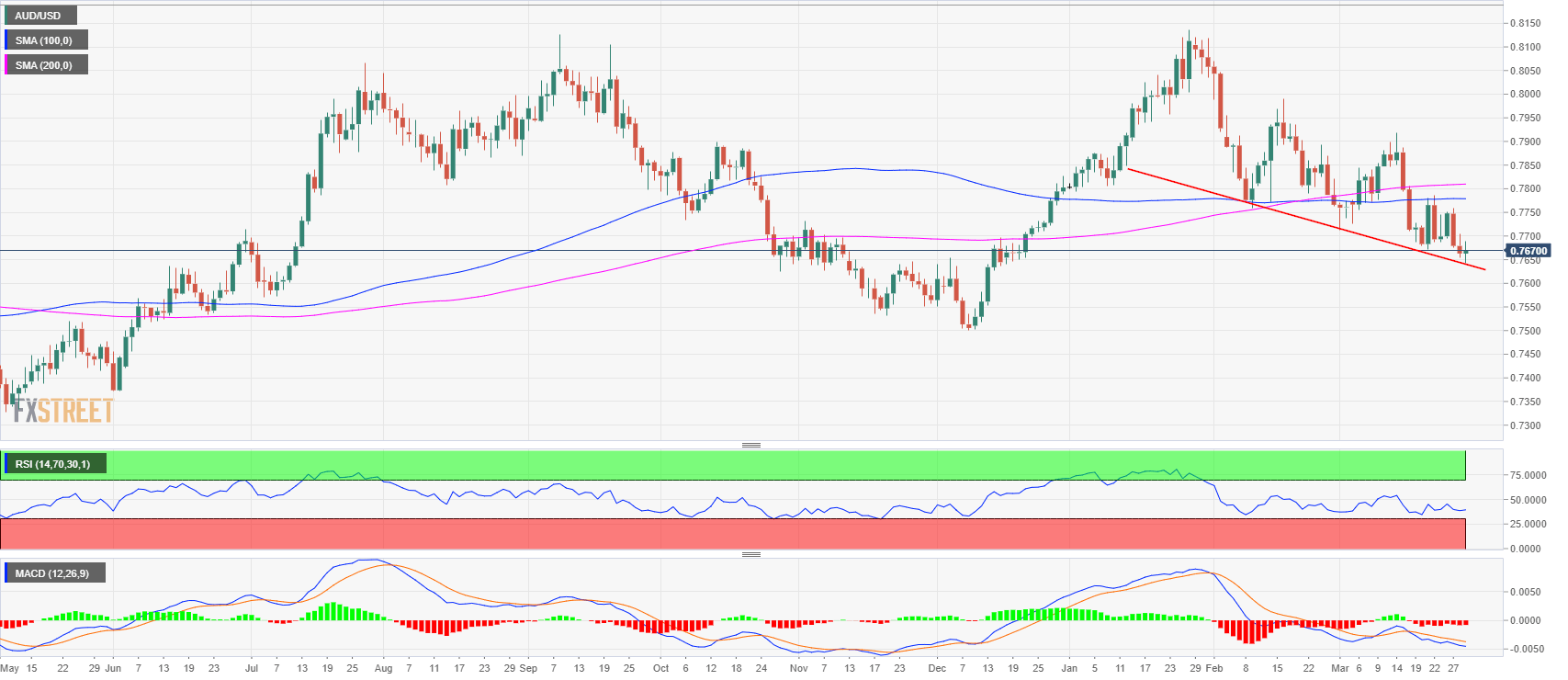

AUD/USD daily chart

The AUD/USD is currently in a rather big wedge bull flag as seen on the daily chart. The market is currently being supported by the descending trendline. A strong break below the trendline could see the Aussie accelerate all the way down to the 0.75 handle last major swing low. Alternatively, the status-quo remains intact and the range continues and the AUD/USD should continue to oscillate between the 0.7650 swing low and 0.7750 high of the week which is now seen as resistance. It is worth noting that an acceleration below the trendline (and below 0.7650), while possible, would be the less likely scenario from a technical standpoint.