GBP/USD Review: Bullish moment on the weak side, latest Brexit proposal appears dead on arrival

- Sterling set to defend the early session's mild gains as London traders get set to digest the latest Brexit rejection from Europe.

- A limited economic calendar this week will be seeing Brexit headlines take center stage once again.

The GBP/USD major pair is shifting its feet near 1.3140 as GBP traders await fresh headlines concerning Brexit ahead of a quiet Monday on the calendar.

The latest Brexit proposal from Prime Minister Theresa May, after much bickering and several close votes within the UK parliament, has been flatly rejected by EU leaders in Brussels, as the 'third option' Brexit proposal would require a sacrifice of European autonomy, a move that is held unacceptable by Brexit negotiators on the EU side. Under PM May's hopeful proposal, the City of London would enjoy unfettered access to European financial markets, a privilege that the European Council maintains strict control over, and intends to retain the right to withdraw that access at any time.

With the latest Brexit proposal dead in the water, Pound traders will be looking for reactions from the UK government through Monday, and will be waiting to see the Prime Minister's next move in an ongoing negotiation between EU leadership in Brussels and hard-line leavers within the UK which see little middle ground being reached between the two sides.

It's going to be a quiet Monday on the economic calendar, with only a speech from the Bank of England's (BoE) MPC Member Haldane due later in the day at 17:00 GMT, and the rest of the week is looking equally inconsequential, with little meaningful data slated for the British Sterling, which may be a welcome reprieve after bulls got hammered in last week's sell-off, pushed further into the red by a raft of disappointing economic figures for the UK's economy, which pushes the chances of an already-dubious rate hike from the BoE out even further.

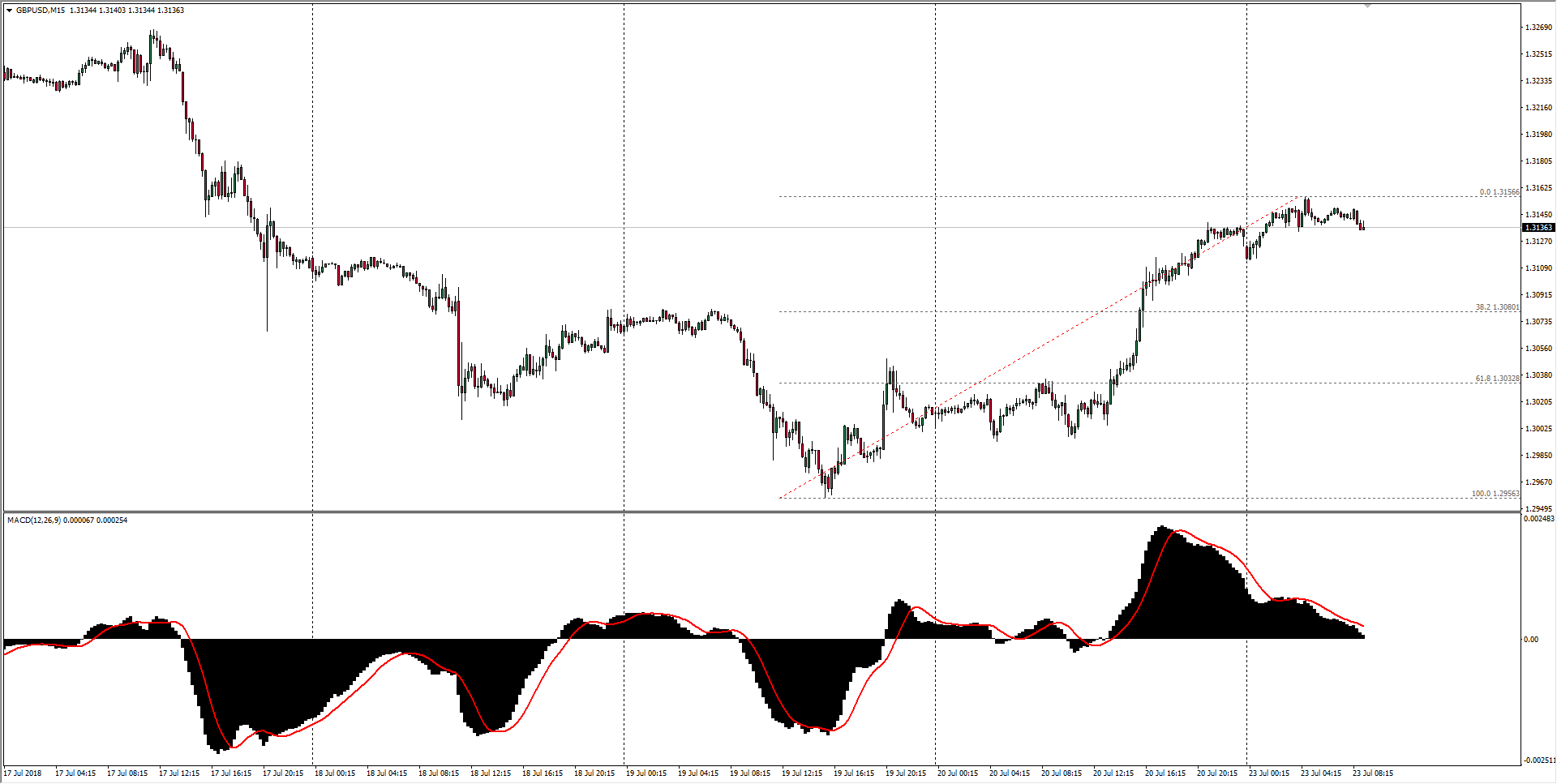

GBP/USD Technical Analysis

The Sterling-Dollar's hourly candles show a bearish divergence between current swing highs and the Relative Strength Index, while hourly Stochastics have rolled over into sell signals and are beginning to drift back into short-side territory. With weakening intraday technicals coming in for a landing ahead of Monday's London market session, key resistance from the 200-hour moving average near 1.3155 can be expected to hold for the next little while.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3136 |

| Relative change: | 0.10% |

| High: | 1.3156 |

| Low: | 1.3114 |

| Trend: | Flat to bearish |

| Support 1: | 1.3114 (current day low) |

| Support 2: | 1.3080 (38.2% Fibo retracement level) |

| Support 3: | 1.2994 (Friday low) |

| Resistance 1: | 1.3156 (current day high) |

| Resistance 2: | 1.3235 (R2 daily pivot) |

| Resistance 3: | 1.3267 (July 17th swing high) |