Back

9 Aug 2018

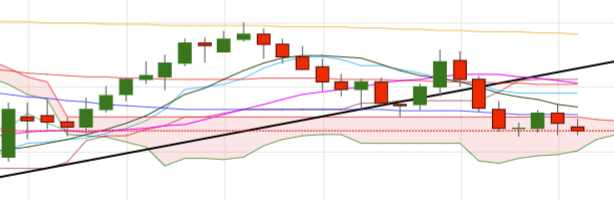

EUR/JPY Technical Analysis: Some decent support emerged in the mid-128.00s so far

- EUR/JPY is prolonging the consolidative theme after the recent breakdown of the 129.00 handle, with some decent contention emerging in the mid-128.00s for the time being.

- The 129.00 neighbourhood, or late July lows, is now considered the interim resistance in case the bullish sentiment returns to the cross. Further out, the cross needs to regain the 130.40 area (June’s highs) in order to allow for a potential visit to the 200-day SMA, today at 131.67.

- In case the bearish view intensifies, sellers should meet the next support in the 126.60 region, or June’s lows. If cleared, YTD lows at 124.61 seen in late May should return to the investors’ radar.

EUR/JPY daily chart

Daily high: 129.06

Daily low: 128.49

Support Levels

S1: 128.45

S2: 128.04

S3: 125.53

Resistance Levels

R1: 129.31

R2: 129.88

R3: 130.29