Back

10 Oct 2018

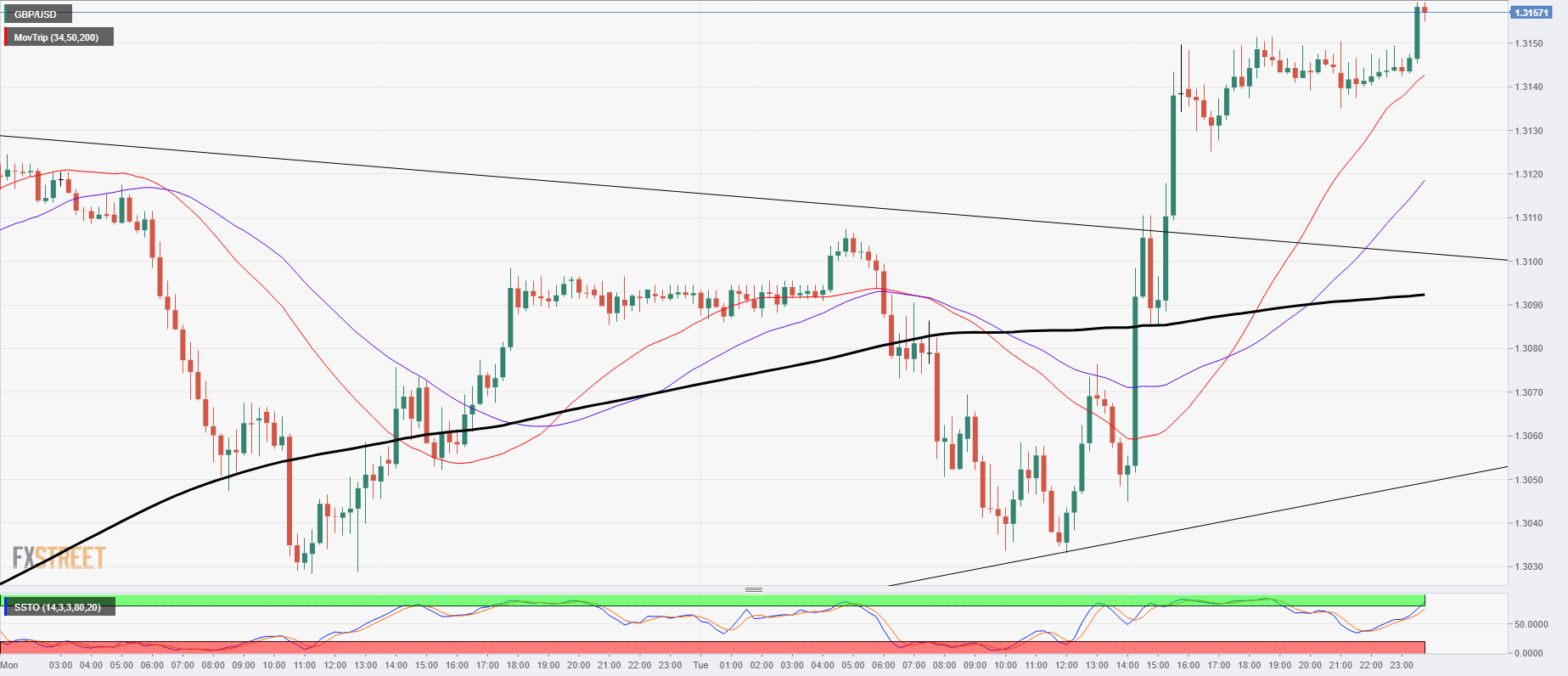

GBP/USD Technical Analysis: Bullish break of a triangle pattern targeting 1.32

- The Sterling is in the middle of an upside break of the upper bound of a sideways triangle on higher timeframes, after rebounding off of support-turned-resistance at the 200-hour moving average near 1.3035, a confluence with the 21-day EMA.

- The pair is now testing into new highs for October, with September's last swing high providing near-term resistance at the 1.32 technical boundary.

- Further support will likely build in from the 50-day EMA near 1.2975 if buyers fail to push the Cable back over the 1.32 barrier.

GBP/USD Chart, 15-Minute

GBP/USD

Overview:

Last Price: 1.3167

Daily change: 23 pips

Daily change: 0.175%

Daily Open: 1.3144

Trends:

Daily SMA20: 1.3096

Daily SMA50: 1.2973

Daily SMA100: 1.3105

Daily SMA200: 1.3496

Levels:

Daily High: 1.3152

Daily Low: 1.3033

Weekly High: 1.3123

Weekly Low: 1.2922

Monthly High: 1.33

Monthly Low: 1.2897

Daily Fibonacci 38.2%: 1.3106

Daily Fibonacci 61.8%: 1.3078

Daily Pivot Point S1: 1.3068

Daily Pivot Point S2: 1.2991

Daily Pivot Point S3: 1.2949

Daily Pivot Point R1: 1.3186

Daily Pivot Point R2: 1.3228

Daily Pivot Point R3: 1.3305