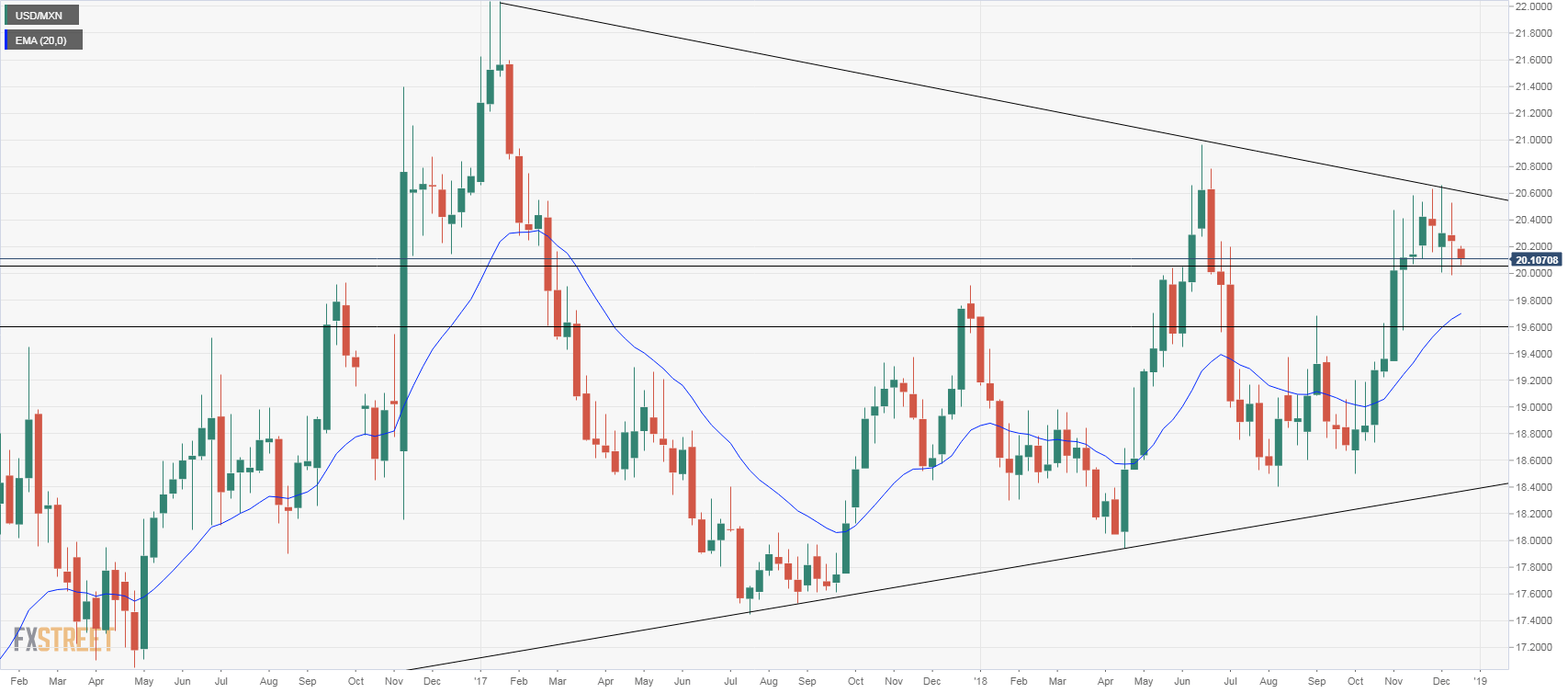

USD/MXN Technical Analysis: Short-term broadening wedge, risks titled to the downside

- The Mexican peso outperformed today after financial markets have positively received the 2019 budget.

- The USD/MXN is moving in a broadening wedge in the short-term, at the moment with a bearish bias that could point to a test of the lower limit. A consolidation significantly below 19.95 would open the doors to an extension of the bearish correction, targeting 19.60/70.

- To the upside, resistance levels are seen at 20.40 and then 20.70. A close above the last one would expose 2018 highs at 20.95/21.00.

USD/MXN 4-hour chart

-636806752959614998.png)

USD/MXN Weekly chart

USD/MXN

Overview:

Today Last Price: 20.1106

Today Daily change %: -0.651%

Today Daily Open: 20.2423

Trends:

Previous Daily SMA20: 20.3407

Previous Daily SMA50: 19.9191

Previous Daily SMA100: 19.4117

Previous Daily SMA200: 19.3054

Levels:

Previous Daily High: 20.5312

Previous Daily Low: 20.1981

Previous Weekly High: 20.5312

Previous Weekly Low: 19.9874

Previous Monthly High: 20.6355

Previous Monthly Low: 19.576

Previous Daily Fibonacci 38.2%: 20.3254

Previous Daily Fibonacci 61.8%: 20.404

Previous Daily Pivot Point S1: 20.1165

Previous Daily Pivot Point S2: 19.9907

Previous Daily Pivot Point S3: 19.7834

Previous Daily Pivot Point R1: 20.4497

Previous Daily Pivot Point R2: 20.657

Previous Daily Pivot Point R3: 20.7828