When is the US ISM Non-Manufacturing PMI and how could it affect EUR/USD?

US ISM Non-Manufacturing PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI), also known as the ISM Services PMI at 15:00 GMT this Tuesday. The consensus forecast for February stands at 57.3, up from previous month's reading of 56.7 but still far from September's 61.6 - the highest since the inception of the composite index in 2008.

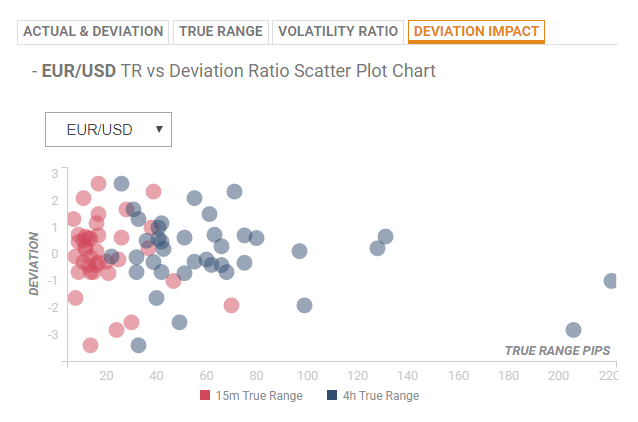

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed, the reaction in case of a relative deviation of +0.90 or -0.69 is likely to be in the range of 22-29 pips in the first 15-minutes and could stretch to around 68-103 pips in the subsequent 4-hours. In the last five releases, the pair moved, on an average, 13-pips in the first 15-minutes after the data release and 38-pips in the following 4-hours.

How could it affect EUR/USD?

Ahead of the release, Yohay Elam, FXStreet's own Analyst offers important technical levels to trade the major: "Support awaits at 1.1310 which was the low point on Monday. Further below, 1.1295 provided some support in mid-February. More importantly, 1.1275 was a swing low around the same period of time. 1.1250 and 1.1235 are below."

"Looking up, 1.1335 supported euro/dollar in late February and 1.1350 was a swing high on Monday. 1.1370 capped the pair in mid-February. 1.1390 and 1.1410 follow after they both served as minor resistance lines. 1.1420 is the last line to watch: it was the February high," he added further.

Key Notes

• ISM Manufacturing PMI Preview: shutdown, what shutdown?

• EUR/USD Forecast: Only a dead cat bounce as bears are in control, selling opportunity?

• EUR/USD Technical Analysis: Bearish continuation - triangle pattern spotted on intraday charts

About the US ISM non-manufacturing PMI

The ISM Non-Manufacturing Index released by the Institute for Supply Management (ISM) shows business conditions in the US non-manufacturing sector. It is worth noting that services constitute the largest sector of the US economy and result above 50 should be seen as supportive for the USD.