Back

22 Oct 2019

GBP/USD technical analysis: Cable trading at daily lows, challenging the 1.2900 figure

- GBP/USD is retracing down from the daily highs, now challenging the 1.2900 handle.

- Brexit headlines are the main Cable drivers.

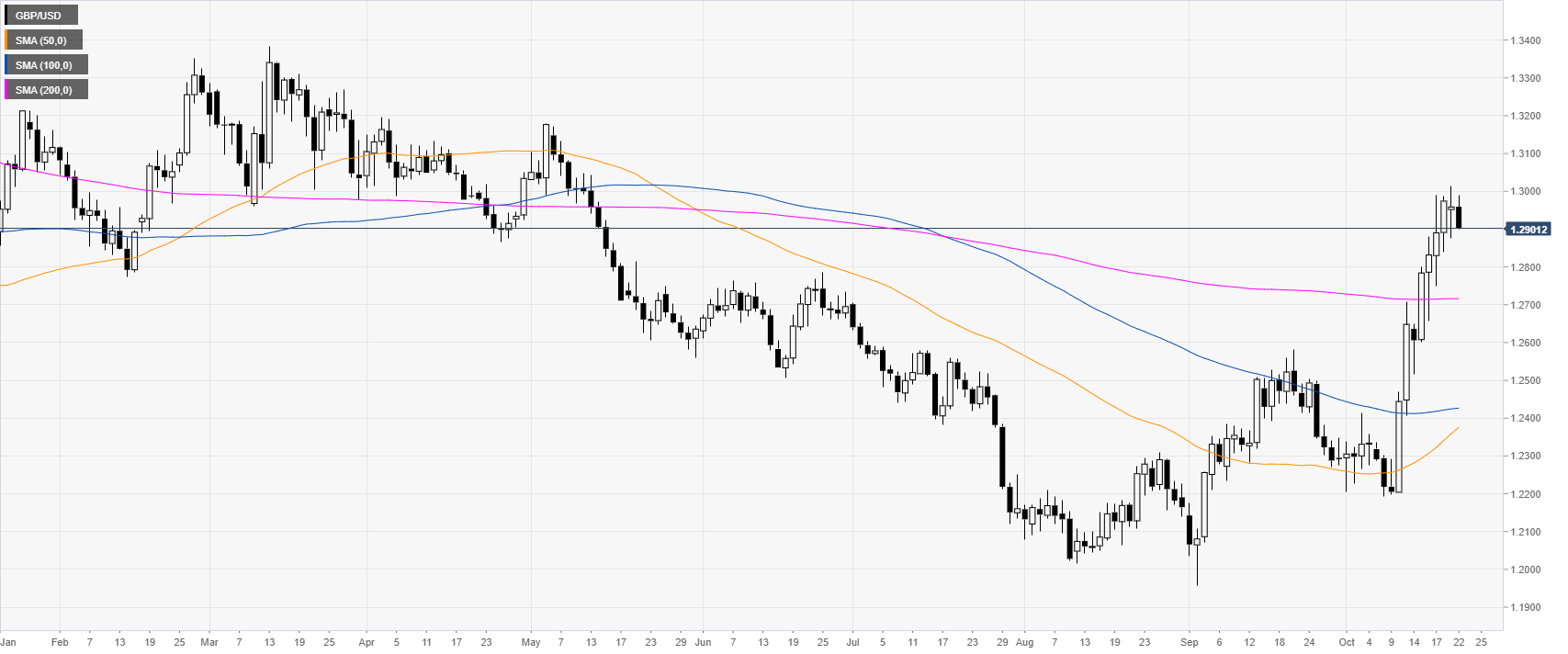

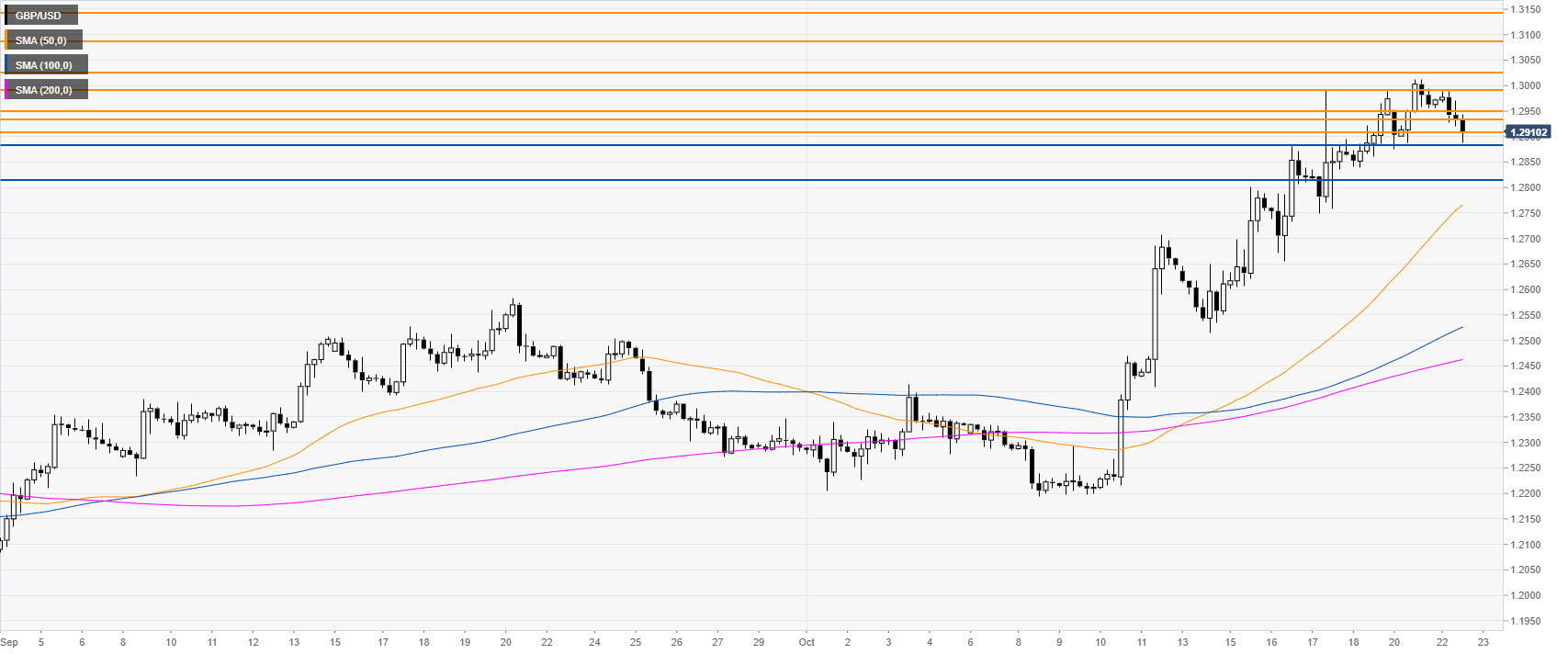

GBP/USD daily chart

The Sterling, on the daily chart, had a spike above the main daily simple moving averages (DSMAs) while reaching levels not seen since mid-May 2019. The Brexit deal optimism fuelled the GBP euphoria of the last weeks.

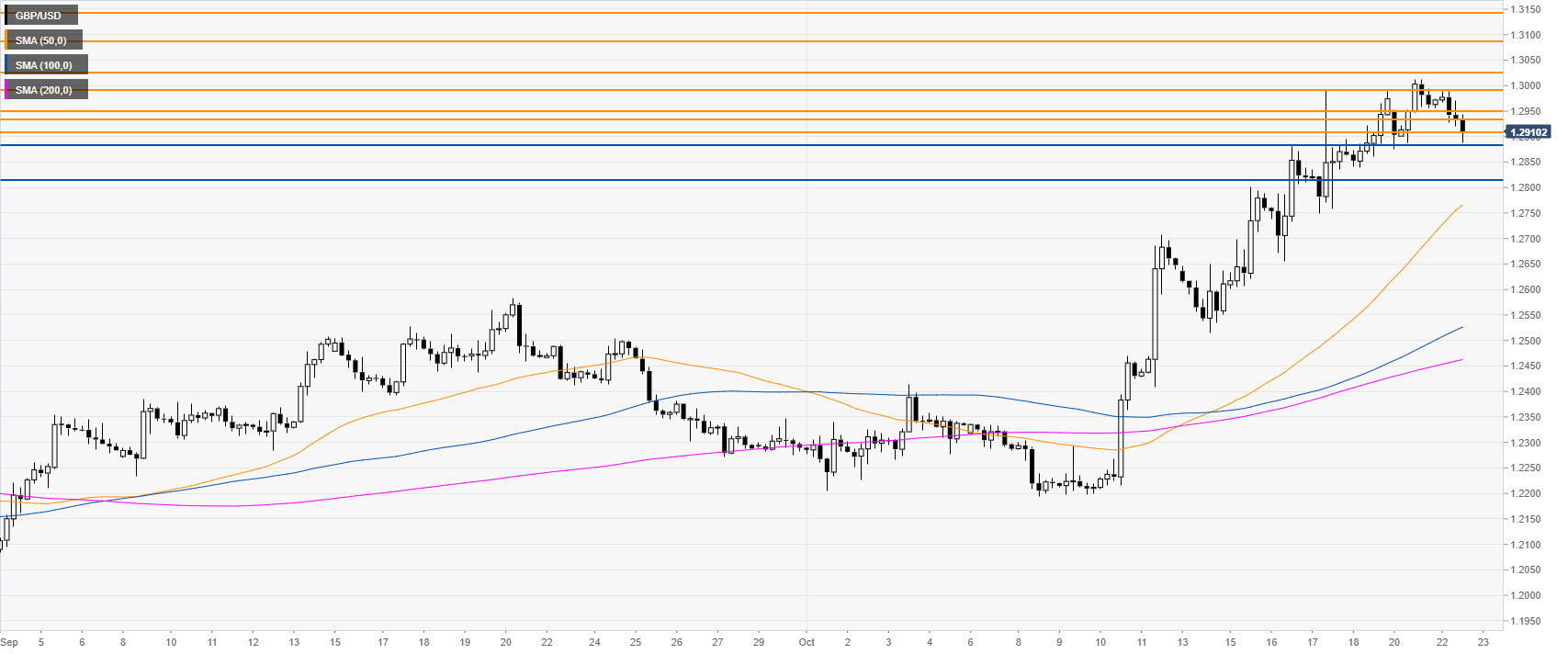

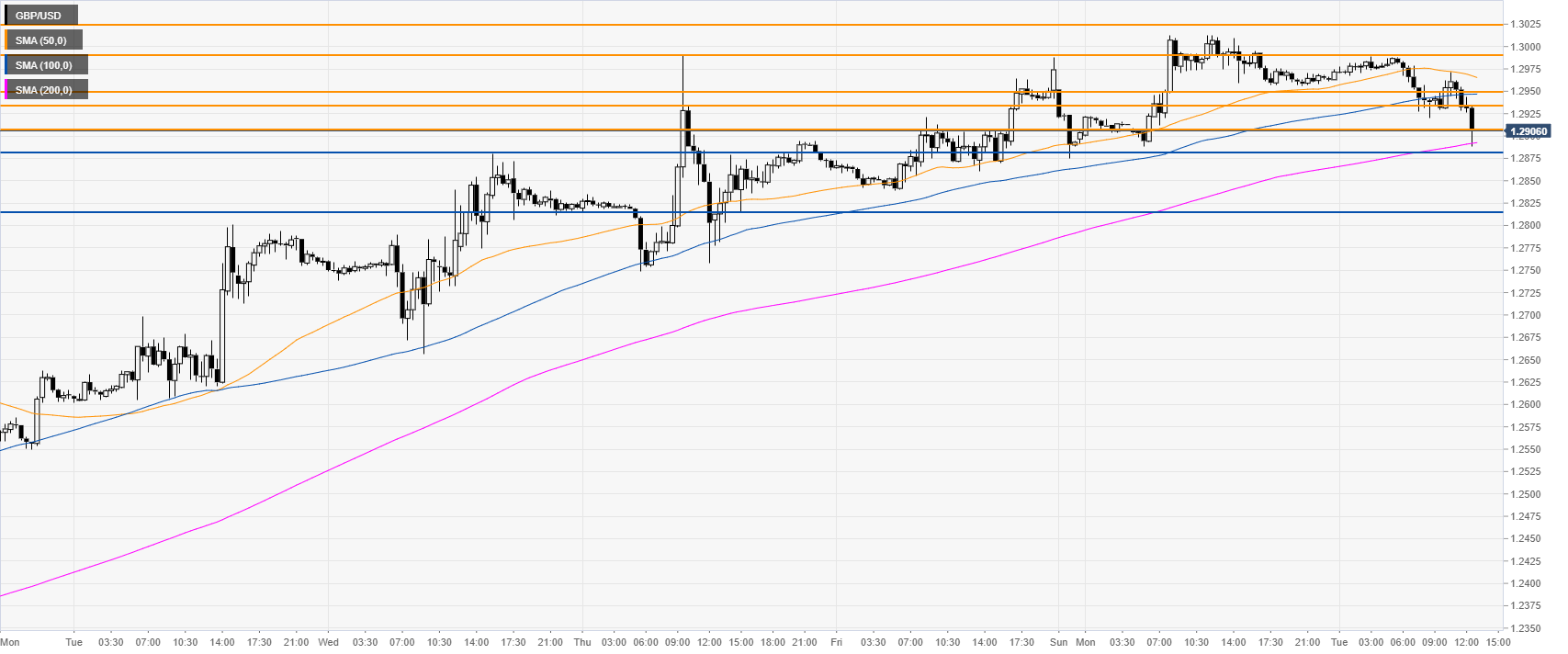

GBP/USD four-hour chart

The Cable is trading in a bull channel above the main SMAs. However, the market is retracing down now, challenging the 1.2881 support level, according to the Technical Confluences Indicator.

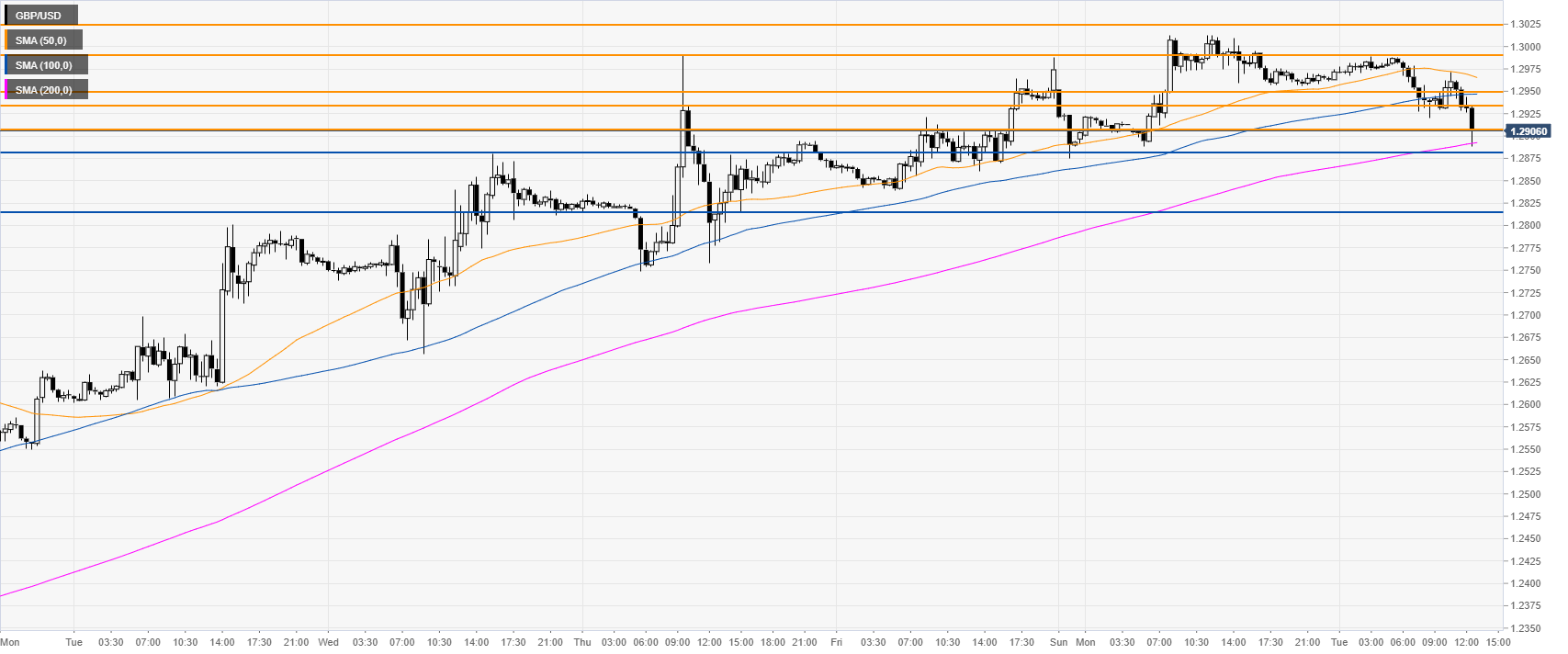

GBP/USD 30-minute chart

GBP/USD is challenging the 200 SMA, suggesting a pullback down in the near term. If bears can break 1.2881, then the market could have a drop towards the 1.2814 level, according to the Technical Confluences Indicator.

On the flip side, if the spot regains the 1.2950 resistance, it can open the doors to a retest of the 1.3000 handle.

Additional key levels