Back

10 Mar 2020

Gold Futures: Upside looks exhausted

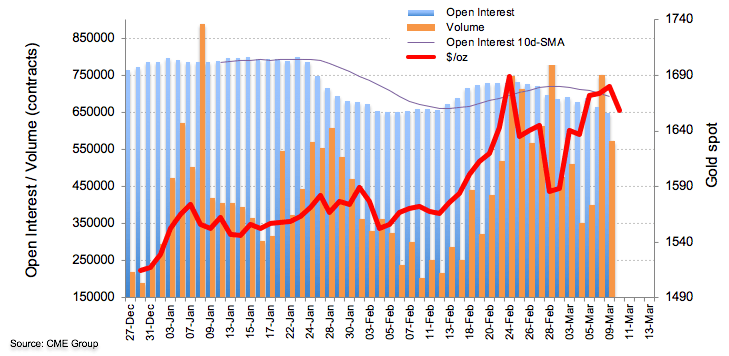

Open interest in Gold futures markets went down for the second session in a row on Monday, this time by around 15.3K contracts, as per preliminary figures from CME Group. In the same line, volume retreated by around 180K contracts after two consecutive builds.

Gold could now attempt a correction lower

The ounce troy of gold briefly printed fresh 2020 highs above the key barrier at $1,700 on Monday. The move up, however, was in tandem with declining open interest and volume, noting that short covering was behind the advance. Against this backdrop and adding the divergence in the daily RSI, a corrective downside in the near-term looks the most likely scenario.