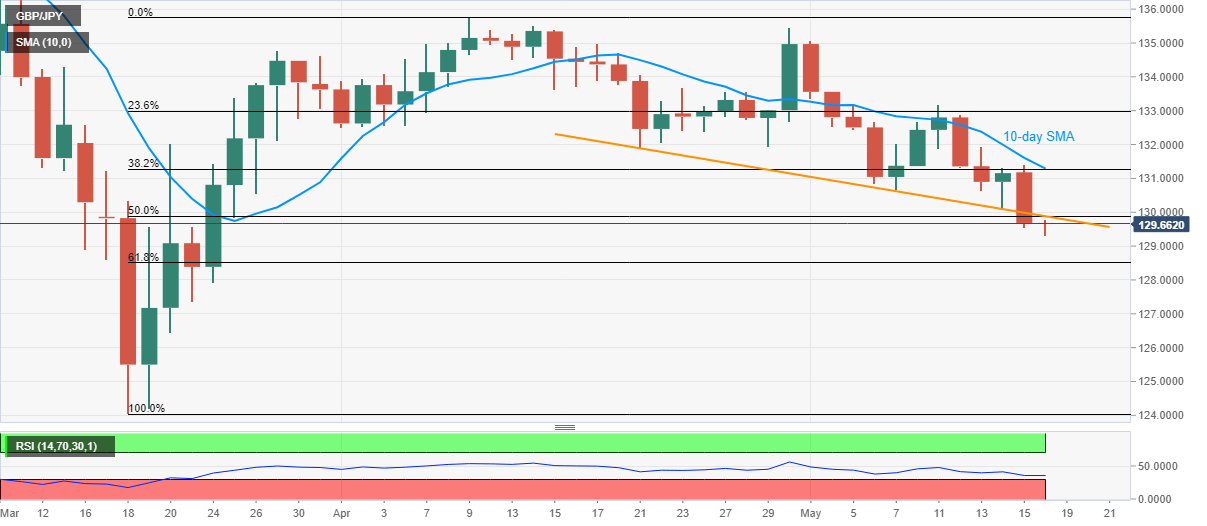

GBP/JPY Price Analysis: Monthly trend line, 50% Fibonacci retracement probes pullback below 130.00

- GBP/JPY recovers from the eight-week bottom, still below short-term key resistance confluence.

- 61.8% Fibonacci retracement holds the key to March month low.

- 10-day SMA, 38.2% Fibonacci retracement adds to the upside barrier.

Despite bouncing off the lowest since March 24, GBP/JPY registers 0.05% loss while taking rounds to 129.60 ahead of Monday’s European session.

The pair’s immediate recoveries are guarded by a confluence of 50% Fibonacci retracement of March-April upside as well as a falling trend line from April 21, around 129.90.

If at all the pair manages to cross 129.90 resistance confluence, it needs to cross 130.00 round-figures to challenge another upside barrier around 131.30 that comprising 10-day SMA and 38.2% Fibonacci retracement.

Meanwhile, the pair’s downside below the intraday low of 129.32 can aim for a 61.8% Fibonacci retracement level of 128.50.

During the quote’s extended declines below 128.50, 127.20 and 125.50/45 can entertain the bears ahead of pleasing them with March month low surrounding 124.05.

GBP/JPY daily chart

Trend: Bearish