Back

10 Jun 2020

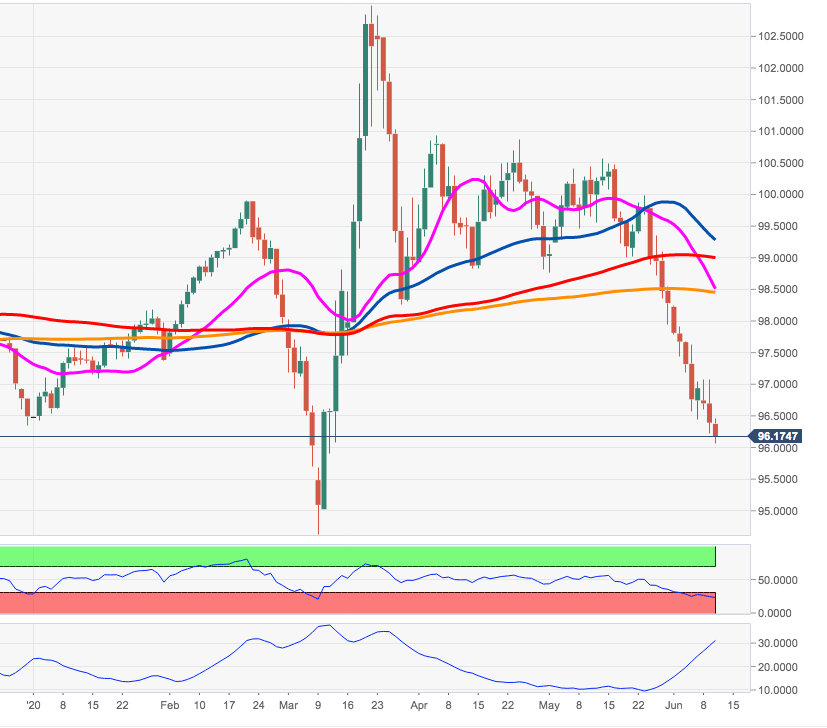

US Dollar Index Price Analysis: Re-shifts the focus to the 96.00 area

- DXY has resumed the downside and returns to 3-month lows.

- Further south now emerges the Fibo retracement at 96.03.

The selling mood around DXY looks anything but abated on Wednesday.

The index is now facing rising odds for a test of the 96.00 neighbourhood, where sits a Fibo retracement (of the 2017-2018 drop).

As long as the upside remains capped by the 2019-2020 line (near 97.00) and the 200-day SMA (at 98.44), further downside remains well on the cards for the dollar.

DXY daily chart