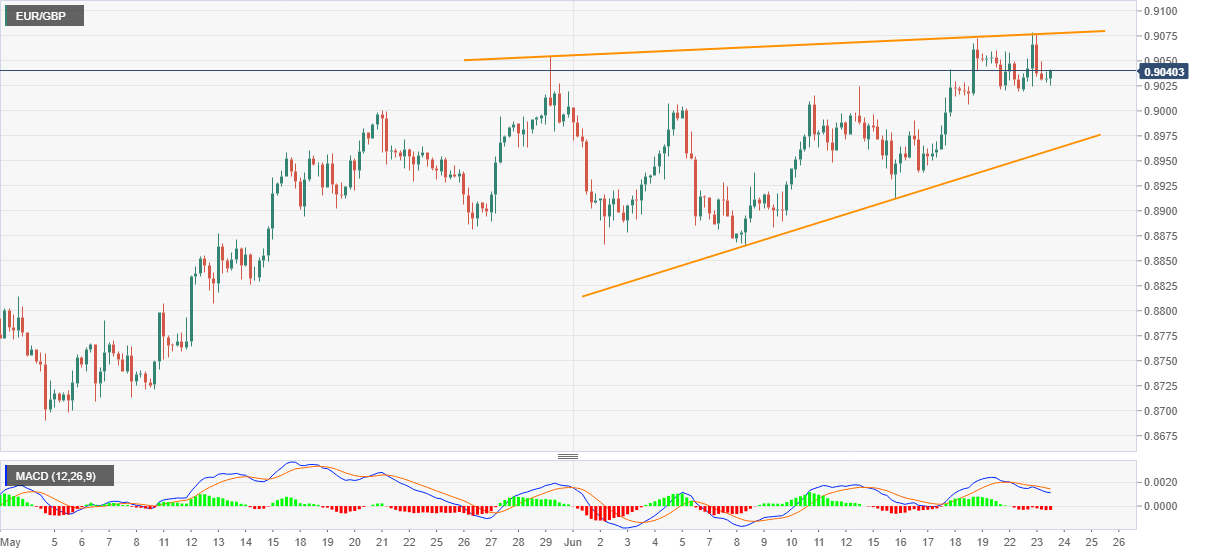

EUR/GBP Price Analysis: Short-term rising wedge keeps bears hopeful above 0.9000

- EUR/GBP stays mildly bid near the monthly top.

- A bearish chart pattern questions further upside amid downbeat MACD.

- The mid-March high could lure the bulls beyond 0.9080.

EUR/GBP prints 0.08% gains while trading around 0.9040 during the pre-European session on Wednesday. Even so, the pair portrays a bearish chart pattern on the four-hour set-up. The move gets further support from the latest pullback from 0.9080 as well as bearish MACD signals.

As a result, the sellers are targeting 0.9000 as immediate support ahead of meeting the formation support near 0.8960. Though, a sustained break below 0.8960 will confirm the bearish play and direct the quote towards a theoretical target around 0.8770.

In doing so, the monthly low near 0.8860 and May 07 high close to 0.8790 could offer intermediate halts during the fall.

On the upside, a clear break above 0.9080 will disappoint bears. However, fresh buying might wait for a sustained rise past-0.9100 round-figure to challenge the March 16 high surrounding 0.9150.

EUR/GBP four-hour chart

Trend: Pullback expected