EUR/USD Price Analysis: Bulls again fail to invalidate a lower high

- Euro bulls struggle to force a breakout above a lower high at 1.1349.

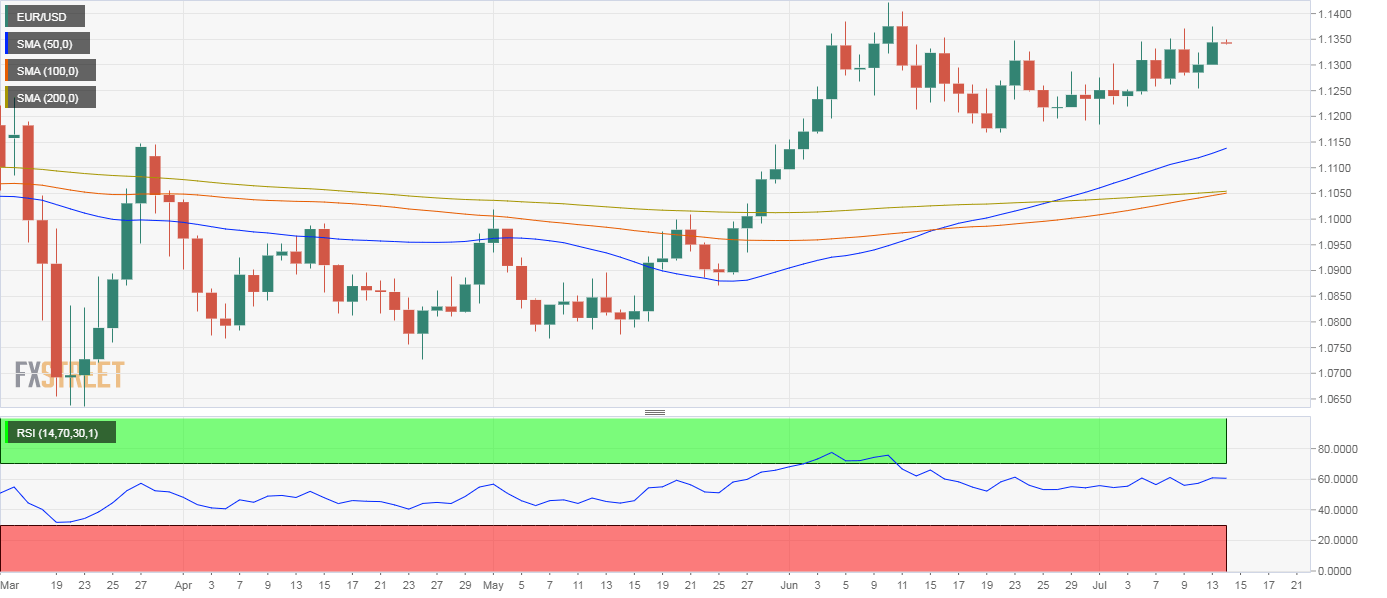

- Daily RSI retains the bullish bias, key averages eye bull cross.

The EUR/USD failed to keep gains above 1.1349 – a lower high created on June 23 – on Monday and was last seen trading largely unchanged on the day near 1.1338.

A bull failure above 1.1349 was first observed last Thursday.

A close above 1.1349 is needed to invalidate the lower high pattern on the daily chart and open the doors for a stronger rally toward 1.1422 (June 10 high) and possibly to 1.15.

Supporting the case for a breakout is the above-50 or bullish reading on the 14-day relative strength index. In addition, the 100-day simple moving average (SMA) is about to cross above the 200-day SMA.

On the lower side, Friday’s low of 1.12 is the level to beat for the sellers. A violation there would shift the focus to the ascending 50-day SMA, currently at 1.1137.

Daily chart

Trend: Bullish above 1.1349