USD/CAD sees choppy trading conditions as US flow returns, Janet Yellen testifies

- USD/CAD has seen choppy trade but is trading back at lows of the day in the 1.2720s.

- Downbeat data and continued concerns over the expected cancellation of Keystone pipeline have failed to weigh on the loonie.

- Markets have remained in an upbeat mood throughout the duration of Yellen’s Senate testimony thus far.

USD/CAD has been choppy in recent trade, rallying from Asia Pacific and European morning levels under 1.2750 to briefly as high as the 1.2760s ahead of US Treasury Secretary nominee Janet Yellen’s testimony to Congress (she is expected to be appointed), before dropping back towards lows of the day around the 1.2720s in more recent trade. Helping cap the price action at the time was the pair’s 21-day moving average, which currently resides at 1.27628. On the day, the pair trades with losses of around 0.2% or 25 pips, with the loonie boosted amid a favourable tone to risk appetite and higher crude oil prices.

Downbeat Manufacturing and Wholesale sales numbers for November (the former dropped 0.6% MoM versus expectations for a decline of 0.1% while the latter rose 0.7% MoM, less that expectations for 1.0%) have failed to dent sentiment towards the loonie. Meanwhile, another domestic theme to keep an eye on will be whether Canadian PM Justin Trudeau can persuade incoming US President Joe Biden to allow the continuation of the Keystone XL pipeline project, the scrapping of which will deliver a blow to the Canadian economy and the prospects for the country’s crude oil export growth. The PM is set to speak to the Alberta Premier later today on the topic.

Yellen testimony mostly as expected thus far…

In her opening remarks, the nominee for position of US Treasury Secretary Janet Yellen effectively endorsed incoming US President Joe Biden’s fiscal stimulus plan, saying that she believes there is a consensus that without further fiscal action, the economy will face deeper scarring at a later date. More aid will be needed in the coming months, she said.

When asked about the new administration’s policy on the US dollar, Yellen said (as expected) that she believes in a market-determined exchange rate.

Regarding taxes, Treasury Secretary nominee Yellen echoed recent remarks from President-elect Biden, saying that she believes in a fair, progressive tax code where the wealthy and corporations pay their fair share. When asked about potential incoming corporation tax hikes, Yellen noted that President-elect Biden has said he would tweak the 2017 tax cuts but would not completely repeal them. She hinted that such tweaks would not happen immediately.

On the debt, Yellen agreed that it is essential to (eventually) put the federal budget onto a sustainable path, but noted that we are in a very low-interest rate environment which represents structural shifts that are likely to be with us for some time. Still, the US needs to watch deficits, she said, though given her endorsement of Biden’s $1.9T rescue package and subsequent, perhaps equally as large, recovery package, she does not seem overly concerned about the 2021 and 2022 fiscal deficits.

Finally, Yellen hinted at the prospect of a wealth tax; capital gains should be taxed at some point, she suggested, arguing that mark to market is one method to look at, but different approaches will be examined.

The remarks are very much in line with what was leaker over the last few days and what markets had been expecting for some time, why there was not much of a market reaction. Note that US bond yields, which had been up on the day, dropped back from highs, perhaps a reflection of a slightly stronger tone on the need for long-term budget sustainability than expected.

USD/CAD still trending to the downside

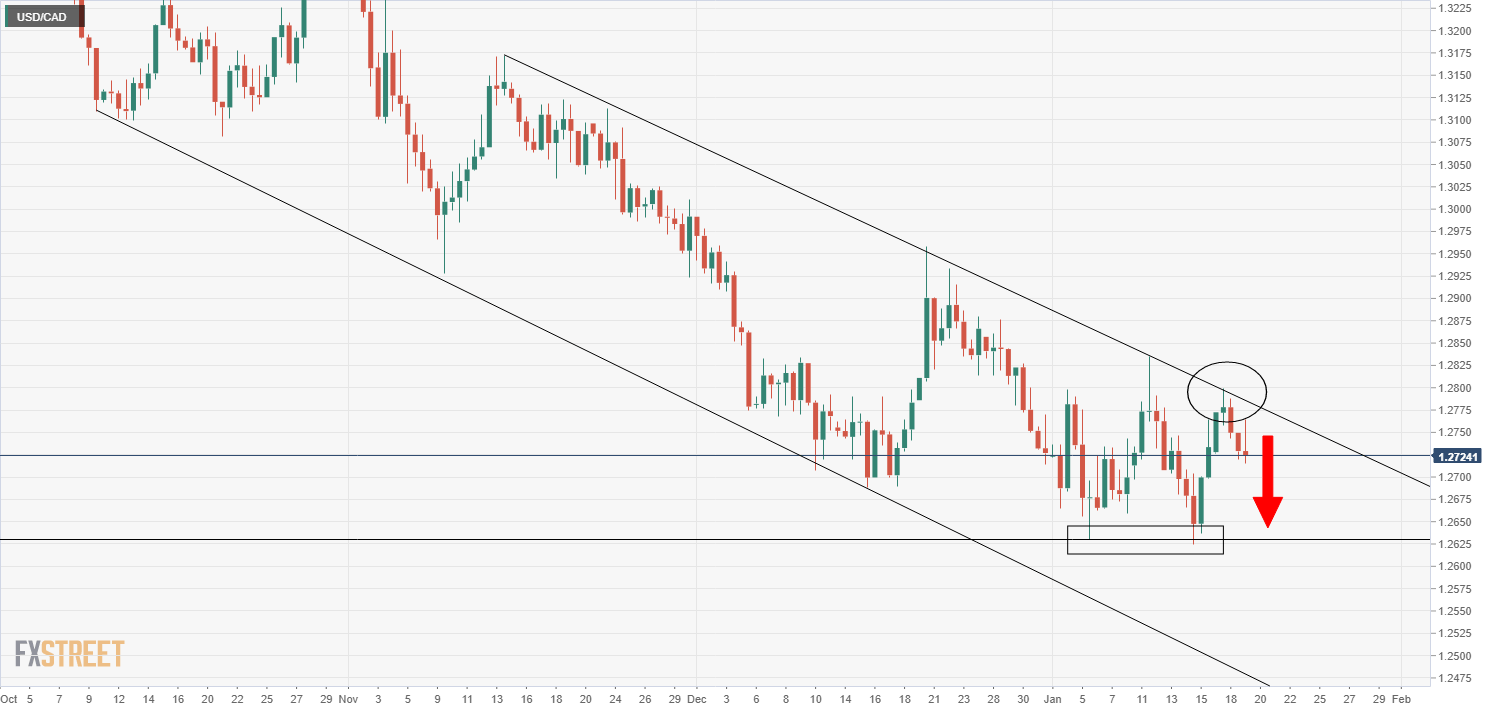

USD/CAD is still trending to the downside when looked at over a longer time horizon; the pair currently resides within a downwards trend channel, constrained to the upside by a downtrend linking the 13 and 23 November, 21 and 21 December and January 2021 highs. The fact that the pair failed to break above this key downtrend earlier in the week implies further losses back towards 2021 lows in the 1.2620s is more likely than not.

USD/CAD 12-hour chart