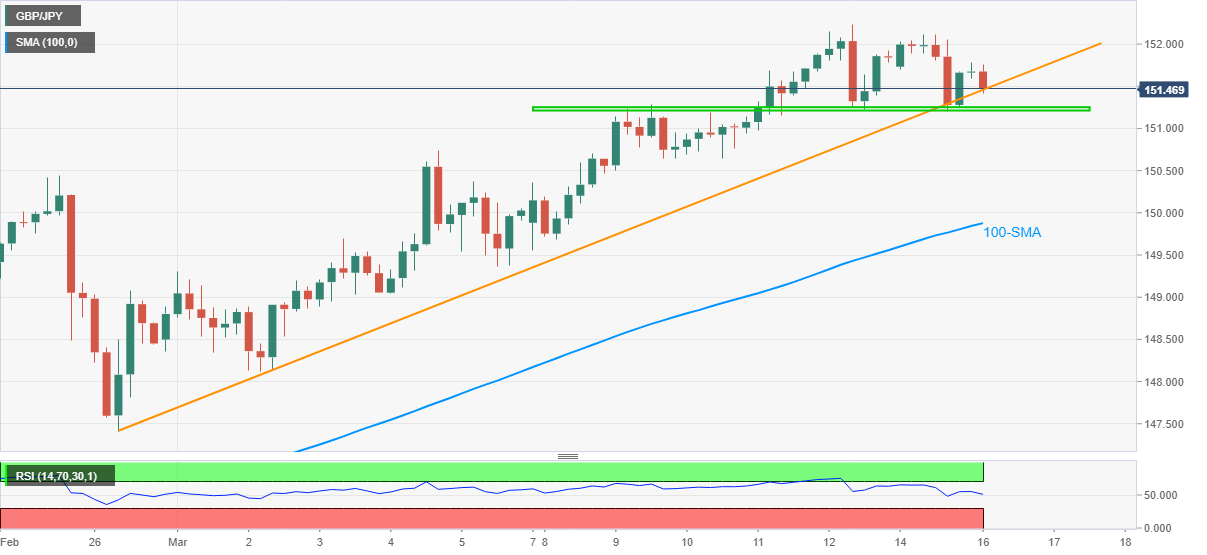

GBP/JPY Price Analysis: Multiple barriers probe further downside around mid-151.00s

- GBP/JPY sellers attack three-week-old support line following Friday’s pullback from multi-month top.

- Descending RSI line favors additional profit-booking but bears will be serious on breaking 100-SMA.

GBP/JPY struggles to overcome the intraday low of 151.41, currently down 0.10% on a day around 151.50, during early Tuesday. In doing so, the quote prints a two-day losing streak as bulls catch a breather around the highest level since April 2018, marked on Friday.

Although downward sloping RSI suggests further consolidation of the recent gains, a sustained break below a three-week-old rising support line and one-week-long horizontal area, respectively around 151.45 and 151.20, will be necessary to convince the short-term sellers.

Even so, highs marked during March 04 and February 25, near 150.70 and 150.45 in that order, precedes the 150.00 threshold to challenge the quote’s further downside.

If at all the GBP/JPY bears dominate past-150.00 psychological magnet, 100-SMA level of 149.87 offers an extra filter to the pair’s south-run.

On the flip side, the 152.00 round-figure can test corrective pullback ahead of highlighting the recent multi-month peak surrounding 152.25.

While the GBP/JPY bulls are likely to cheer an upside break of 152.25 to target April 2018 peak surrounding 153.85, any further upside will be challenged by overbought RSI conditions.

GBP/JPY four-hour chart

Trend: Bullish