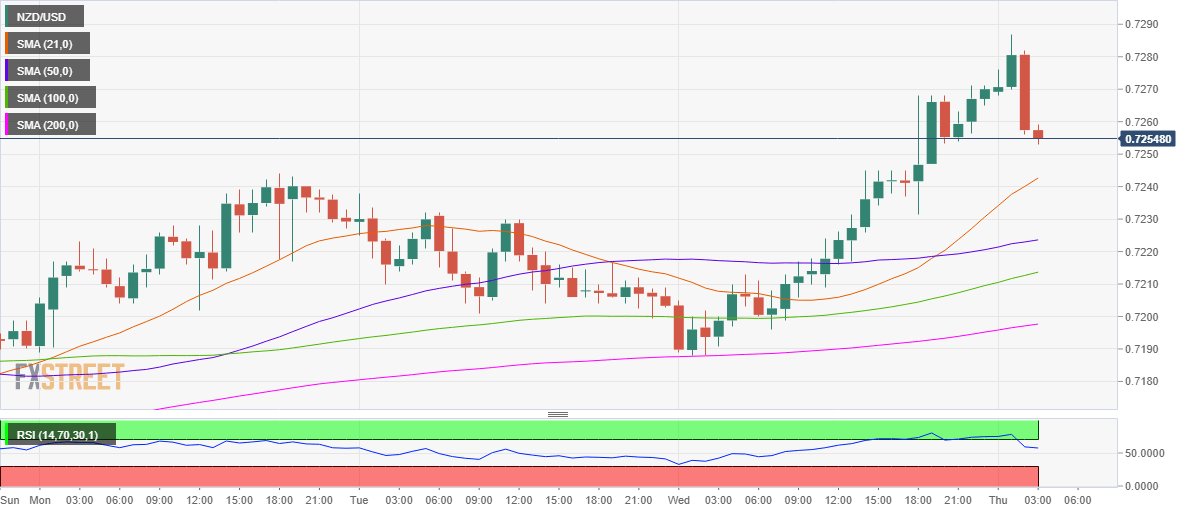

NZD/USD Price Analysis: Drops amid overbought RSI, eyes 21-HMA support

- NZD sellers return after rejection just below 0.73 as USD rebounds.

- The kiwi corrects after overbought RSI on the 1H chart.

- 21-HMA support holds the key for the kiwi optimists.

NZD/USD is correcting from eight-week highs of 0.7287, as the US dollar is attempting a comeback across its main peers after the dovish Fed-induced sell-off.

Meanwhile, the recent surge in commodities and stock prices also benefits the higher-yielding kiwi.

At the time of writing, the Kiwi trades at 0.7255, modestly flat on the day, looking to test the bullish 21-hourly moving average (HMA) support at 0.7243.

The latest leg down in the spot can be attributed to the overbought conditions on the Relative Strength Index (RSI), as the oscillator turned south and dragged the price lower alongside.

A break below that level could expose the 0.7200 demand area, which will act as strong support.

NZD/USD hourly chart

Alternatively, if the 21-HMA holds, the bulls could attempt another bounce towards the multi-week highs of 0.7287, above which the 0.7300 threshold could be challenged.

A sustained move above the latter could threaten the March high of 0.7308.

NZD/USD additional levels to watch